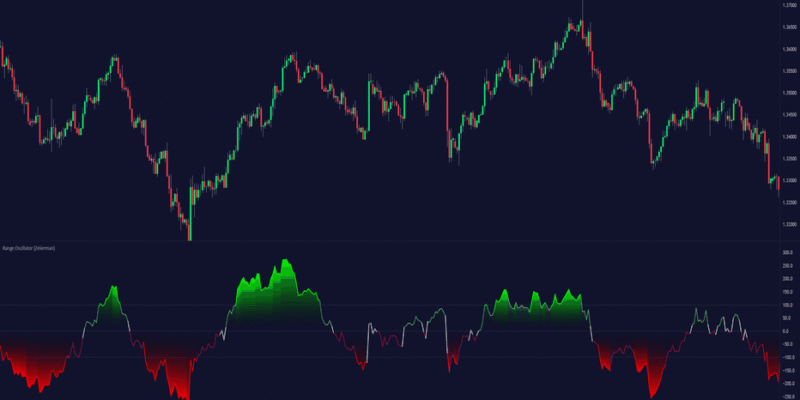

The TradingView heatmaps offer traders a strong visual assistance in determining probable market opportunities as it gives the real-time data on trend and relative performance. These heatmaps can make the process of identifying the trends, assets strengths, and weaknesses across various asset classes easier to identify and enable the traders to make quicker and more accurate decisions. Users can have a clear glimpse of what markets are catching or losing momentum when they move through the numerous charts, which otherwise they have to scroll through to get the clear picture.

The TradingView heatmaps display color-coded market data. Performing assets are normally represented by color green whereas under performing ones are colored red. The severity of the color is the severity of the change, which traders can make a quick determination of the instruments that are moving substantially. It is easier to identify performing areas or under-performing assets in this visualization without breaking down each chart separately.

Heatmaps may also be applied to track index, industry, or stock performance by the equity trader. Even a look at the map can give some idea about the sectors which are performing better or worse which gives information on the general mood of the market. To illustrate, when technology and consumer discretionary stocks take the majority of the green zones, it might be a sign of the risk-on attitude of investors. On the other hand, when defensive industries like utilities and healthcare are seen to be doing better, it may mark the beginning of risk aversion.

Heatmaps can also be helpful to forex traders since they can observe currency strength and weakness. When trading through the simultaneous comparison of multiple currency pairs, traders are able to determine which currencies are appreciating or depreciating throughout the market. This makes it easier to match strong and weak currencies to create more likely trade arrangements. One of the traders who observes a consistent strength in the U.S. dollar, and the weakness in the Japanese yen, such as USD/JPY may be interested in trading it.

Heatmaps allow crypto traders to evaluate market sentiments and volatility of the top digital assets. Cryptocurrency markets are 24/7, and therefore, a heatmap can be used to rapidly show changes in momentum or locate coins with strange movement. This is applicable in assisting traders to identify possible breakouts or corrections on time. Through the use of heatmaps, volume, and liquidity, a user can optimize their entry and exit strategy in the dynamic crypto market.

The other strength of TradingView heatmaps is customization. The traders are able to filter the data to narrow in on specific markets, time and instruments. This allows making a more specific market market analysis, corresponding to the specific trading strategies. It is possible to combine the use of heatmaps and other TradingView features like watchlists, alerts, and technical indicators to make the entire platform more effective and keep traders updated and flexible.

Finally, TradingView heatmaps can be considered an effective tool to offer a visual interpretation of intricate market data. They minimize the time wastage involved in scanning different charts and enhance situational awareness in different markets. By establishing correlations, deviations and new patterns, traders will be able to be more decisive and take advantage of the opportunities in time. Heatmaps are a nice addition to the collection of analytical tools offered by TradingView that anyone may resort to to improve their market analysis.