Credit scores are checked by various lenders, which provide you with loans such as banks providing mortgage loans, car dealerships which finance purchases and also credit card companies to ensure that they should offer credit to an individual or not and if they do offer it what the terms would be.

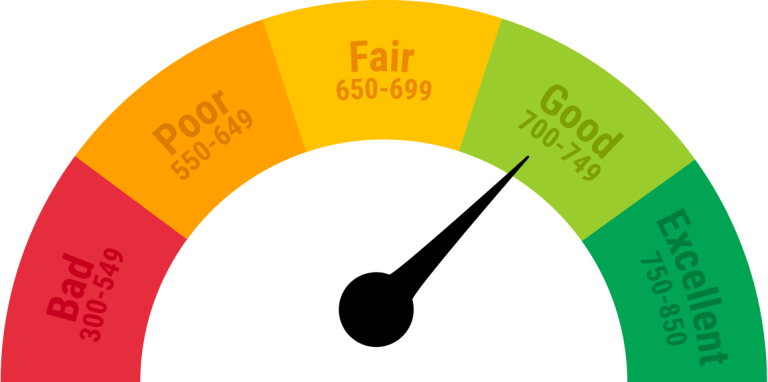

A common range of credit score is 300 to 850 and within the range, a credit score above 700 is generally considered to be an outstanding score while a majority of scores fall between the range of 600 and 750.

The higher your score the better your chances of getting credit would be as a higher score means that you are responsible for the decisions that you make on your credit and more likely to repay any future debts.

There are various types of credit scores utilized by different companies and areas. FICO Scores, CIBIL Scores, and Vantage scores are some such credit score ranges but there are also various scores that exist which are industry specific.

Why Credit Scores Matter?

An individual’s credit score review decides how likely it is that they’ll be able to repay the loan or credit they take in the given time. This is used by many money lenders to decide if the individual is worth the risk of lending credit or not that’s why a credit score is sometimes referred to as a risk score.

Therefore, having a good credit score becomes very important as it determines how trustworthy you are and whether you will get a loan or not. Also, there would be a substantial difference in the savings, if the person qualifies for a loan with a low-interest rate. A good credit score means that you can rent the house that you want or buy the thing that you require on credit.

The credit score of an individual is not a part of your credit history but it is generated every time a moneylender requires it and mostly the model of credit scoring is of the lender’s choice.

However, individuals’ credit scores are not the only thing that decides whether you’ll get a credit or a loan. Other things that are considered while going over your request for a loan is the information provided with your credit scores such as the amount of time you have had the credit account, the munt of your debt and even the type of credit you have in your report. The creditors might also consider looking over your debt to income ratio.

Conclusion:

A person should maintain a good credit score and one of the better scoring models to check your score is the CIBIL credit score which you can learn about by looking up how to check CIBIL score online. A good CIBIL score lies between 700 to 900. If you want to learn more about credit scores you can look up Recharge on YouTube where the speaker Govind provides insightful videos on tech tips, tech-related and also videos on other topics such as credit scores. Govind also provides a critical analysis of various upcoming technologies and news related to issues surrounding technology.